02 Feb Understanding Your Payslip with EA Assist Ltd

Are you new to Payroll or new to Employment?

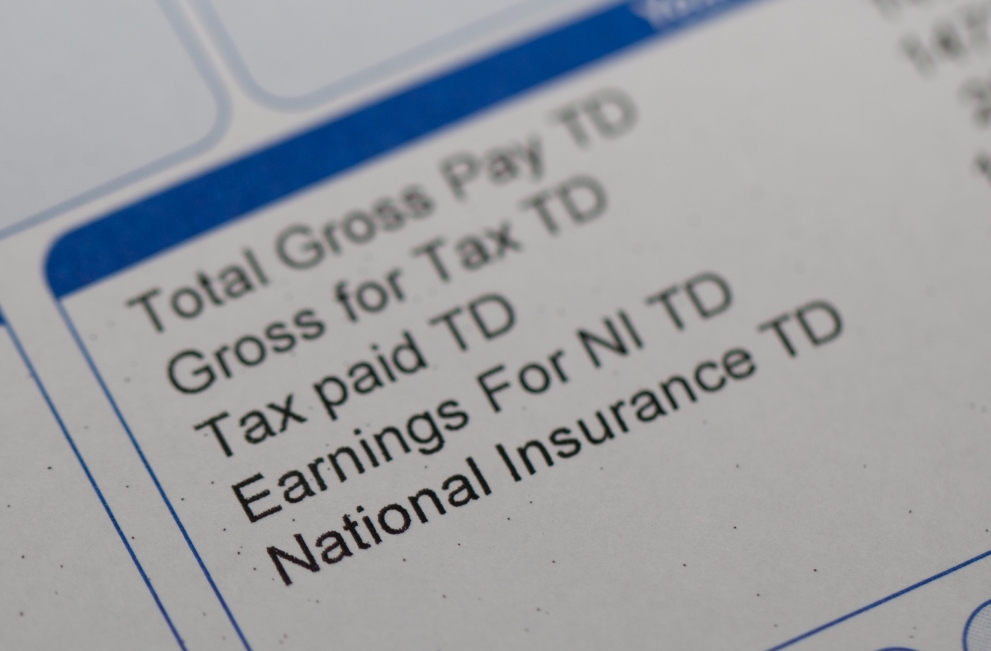

Are you new to payroll or new to employment have a quick read through this basic information to help you understand our payslip and what all the headings and numbers relate to.

- Gross Pay: What you have earned before deductions including overtime and bonuses etc.

- Basic Pay: This is your agreed salary before any overtime or bonuses.

- Net Pay: This is the figure you will be paid after the deduction of tax, national Insurance and any other deductions agreed or imposed on by your employer.

- PAYE: This figure includes your tax and National Insurance deductions which maybe separately identified on your payslip.

What other references will there be on your payslip?

- Employee number: your unique reference given to you by your employer.

- National Insurance Number: when you turn 16 you will be sent your own unique National Insurance number that will stay with you. It will be required by all employers to register you with their payroll.

- Tax Code: HMRC will give your employer your Tax Code which will be shown on your payslip. This tells them how to apply tax to your earnings. To find out more about tax codes and what they mean click here.

- Tax period or Period: This refers to the period for which the tax was calculated. Monthly payslips will show a number from 1 to 12 – month one being April. Weekly will show a number from 1 to 52 with week 1 in April and 52 at the end of March.

Do you know what your deductions mean?

- Employee NI – this is the amount deducted for your National Insurance contributions.

- Employers NI – this is the amount your employer contributes on earnings and benefits of their employees.

- YTD – Your payslip will show your ‘year to date’ contributions which is the payments you have made in this tax period to date.

- Earnings for tax / Earnings for NI – this is the earnings that are subject to tax or national insurance – this can be shown for the pay period or the year to date.

- Other – there may be other deductions such as pension contributions , payments for childcare, student loan payments and others which are personal to you.

It can be complicated understanding your first payslips but if you have any queries or questions then ask your payroll department directly. They should be able to help.

Did you know you can have all your payslips accessed via on-line portal meaning you never need spend hours searching for those payslips again. If you don’t have this already, ask your payroll department about it.

If you are a small business struggling with managing your payroll function then give us a call now. EA Assist offers a cost effective payroll solution for businesses both locally and nationally.

Call us now to find out how we can help on 01379 646943.